Loan Deferment

LOAN DEFERMENT

Loan deferment is when a borrower is allowed to temporarily halt making payments on their principal and interest of a loan for an agreed-upon time. Initially, the loan deferment introduced by the government in April 2020 allowed borrowers to make a deferment on their payments for a period of 6 months.

PREFACE

It is important that borrowers practice financial discipline to repay the arrears owed to the banks and strive to cultivate a good record of loan repayment as the viability of a credit system depends on loans being repaid.

When loans are not serviced, banks have to start providing for it even though there may be recoveries after a year or two. When provisions start to rise, the risk profile rises as well, causing banks to stop giving out loans. Banks have to be profitable to continue to give out loans. If banks are not profitable, the wider economy will be impacted.1

Malaysia’s household debt is one of the highest in the world at 90 per cent compared with more advanced economies such as follows 2:-

- Germany at 55 percent

- United States of America at 85 percent

- Hong Kong at 82.7 percent

- Singapore 65 percent

This was why according to Bank Negara Malaysia (BNM) governor Datuk Nor Shamsiah Mohd Yunus (as she was then) stated that with the expiry of the blanket moratorium in September 2020, a targeted approach in loan repayment assistance was better as it put the choice in the hands of the borrowers where they would be able to obtain tailored assistance to meet their financial circumstances. It was also noted at the time by BNM that borrowers were making informed choices in managing their debt based on what they can afford as many are not asking for moratorium and they do not want a one-size-fits-all solution 3.

In a virtual press conference held on 11 May 2021, BNM governor Datuk Nor Shamsiah Mohd Yunus said that following the re-imposition of the nationwide MCO 3.0, a blanket loan moratorium may still not be the best solution as all banks already have their payment assistance plans which can be offered to borrowers who have lost their jobs or suffered a reduction in income. She went on to add that borrowers can also approach the multiple channels that have been set up if they require advice or further assistance and unlike the previous MCO in 2020, nearly all economic sectors are allowed to operate 4. These sentiments were also reiterated by ABM in a press release dated 12 May 2021 where it stated that its member banks would continue to make available repayment assistance to affected borrowers. Borrowers who were in need of assistance were encouraged to contact their banks early to discuss repayment assistance options 5 .

The banking industry continues to actively reach out to borrowers in various ways and to ease the application process, banks have simplified the application process and enabled the entire process to be done online. Our member banks are sympathetic towards the plight of their borrowers who have been negatively affected by the COVID-19 pandemic and have been working closely with the regulator to ensure that assistance continues to be provided to affected borrowers. The banks have supported borrowers through the challenging economic environment since the start of the COVID-19 pandemic and remain determined to support borrowers, as well as the economy in general, navigate out of the pandemic.

1https://www.thestar.com.my/business/business-news/2020/12/05/tell-tale-signs-from-banks-rising-provisions

2http://www.nama.com.my/PRINT_NEWS/2020/11/14/20201114_N60_BNM_ZZ_0_FC_MAY~THE~LIGHT~GUIDE~US~TO~GOOD~FINANCIAL~MANAGEMENT.JPG

3https://www.nama.com.my/PRINT_NEWS/2021/02/12/20210212_N60_NST_BZ_19_BW_TARGETED~APPROACH~BETTER~THAN~AUTOMATIC~BLANKET~MORATORIUMS.JPG

4https://www.nama.com.my/PRINT_NEWS/2021/05/12/20210512_N60_BOR_BZ_2_BW_MCO~3.0~BLANKET~LOAN.JPG

5https://www.abm.org.my/media-room/press-releases/item/1030-repayment-assistance-continues-to-be-available

WHAT DO I NEED TO KNOW?

The following are the measures (starting with the most recent measures) that have been implemented in Malaysia to-date since the Movement Control Order (MCO) in March 2020:

14 October 2021 – Following the statement made by Prime Minister Datuk Seri Ismail Sabri Yaakob on the financial assistance scheme1, the banking industry announced a scheme designed with the objective to help eligible B50 customers alleviate their financial difficulties caused by the COVID-19 pandemic. The scheme which is a collaboration between banks and Agensi Kaunseling dan Pengurusan Kredit (AKPK) is open to individual customers, on application, who are under an existing repayment assistance programme as at 30 September 2021.

The Financial Management and Resilience Programme, “URUS” is a comprehensive financial aid initiative aimed at affected borrowers in the B50 category. B50 borrowers who are under an existing restructuring scheme as at 30 September 2021, whose gross household income is RM5,880 or lower, have experienced either loss of employment or reduction of income of at least 50% and those whose loans are still performing (not in arrears exceeding 90 days) as at the date of their application are eligible for URUS. The financial plan will encompass the option of an interest waiver for a period of 3 months, commencing the month following the customer’s onboarding into the scheme; or a 3-month interest waiver together with reduced instalments for a period of up to 24 months in total. It is estimated that banks will be setting aside an estimated RM1 billion to fund the cost of the reduction in interest including interest waiver for the vulnerable B50 customers2.

Finance Minister Tengku Datuk Seri Utama Zafrul Tengku Abdul Aziz stated that URUS which is managed by AKPK will provide comprehensive help to borrowers, ensuring that those in need will receive government support which is consistent with the spirit of Keluarga Malaysia. He announced that applications for URUS will be open from 15 November 2021 to 31 January 20223.

In a press release by BNM the same day, Governor Datuk Nor Shamsiah Mohd Yunus stated that the implementation of URUS is in line with efforts to provide appropriate support to borrowers so that they not only meet their loan obligations but importantly, return to a firmer financial footing. BNM also stated that borrowers who are not eligible for URUS may also approach their banks to discuss other repayment solutions that suit their financial circumstances4.

25 January 2022 - In a joint press release by the banking associations and AKPK, it was announced that the application for URUS has been extended from 31 January 2022 to 31 March 2022.5

In addition, for eligible B50 customers who have signed up for the banks\' flood relief assistance programmes, the URUS application closing date has been extended to 31 July 2022, or upon the expiry of the flood relief assistance programme, whichever is earlier.

29 June 2021 - In a joint press release, ABM stated that in line with the announcement by the Prime Minister of Malaysia on the National People’s Well-Being and Economic Recovery Package (PEMULIH package) on 28 June 2021 member banks’ will continue to provide comprehensive support to all individuals including borrowers from the B40, M40 and T20 groups, microenterprises and all SMEs that have been affected by the COVID-19 pandemic by offering a 6-month moratorium on the installment of all credit facilities (excluding credit cards) for these borrowers on an opt in basis.

For this scheme, borrowers are only required to contact their banks from 7 July 2021 onwards to benefit from the moratorium and approval will be given automatically to all borrowers in the categories mentioned above. ABM went on to state that banks are committed to make the process as easy and seamless as possible and no supporting documentation is requested upfront for approval purposes1.

1 July 2021 - In the 59th National Inter-Agency Economic Stimulus Implementation and Coordination Unit (LAKSANA) report, Finance Minister Tengku Datuk Seri Utama Zafrul Tengku Abdul Aziz announced that the six-month moratorium offered through the National People\'s Well-Being and Economic Recovery Package (PEMULIH) is estimated to bring relief of up to RM80 billion to individuals and business borrowers. In his announcement, he stressed that banks would waive compounded interest and penalty charges for borrowers who take up the loan moratorium while only accrued interest is charged as usual when the borrower starts making payments after six months. He also went on to mention that it is the second time Malaysia has introduced a comprehensive loan moratorium after its debut in March last year and no other country in the world has given a comprehensive moratorium like this, in fact, most of them only provide targeted and limited loan assistance2.

2 July 2021 - BNM made an announcement in its press release that they will increase the allocation for the All Economic Sector (AES) Facility by RM2 billion, bringing the total allocation to RM6.5 billion. BNM went on to state that the AES is open to SMEs from all sectors of the economy, and aims to enhance SMEs’ access to financing and support growth3.

Based on BNM’s website, between 1 June 2021 and 24 December 2021, more than 2.7 million individual borrowers and 95,700 SME borrowers have obtained repayment assistance4.

1https://www.abm.org.my/media-room/press-releases/item/1175-joint-press-release-from-abm-aibim-banks-to-offer-6-month-moratorium-from-7-july-in-line-with-pemulih-package

2https://www.mof.gov.my/en/news/press-citations/tengku-zafrul-pemulih-moratorium-estimated-at-rm80-bln-malaysia-only-country-implementing-it-for-second-time

3https://www.bnm.gov.my/-/enhancements-to-facilities-under-bnm-fund-for-smes

4https://www.bnm.gov.my/ra

6 November 2020 - Following the announcement by the Finance Minister of Malaysia, YB Senator Tengku Dato’ Sri Zafrul Tengku Abdul Aziz (as he was then) during the 2021 Budget speech, BNM issued a press release to provide additional details on the announced measures to households and businesses affected by COVID-19. The Finance Minister said that to-date, more than 650,000 applications for repayment assistance have been received, with a high approval rate of 98%1. The following measures are part of continuous efforts by the financial industry to support economic recovery, while also safeguarding the livelihoods of Malaysians2:-

- Enhanced targeted repayment assistance.

- Establish additional financing facilities to provide relief and support recovery for SMEs i.e. RM2 billion Targeted Relief and Recovery Facility (TRRF), RM500 million High Tech Facility (HTF) and RM110 million increase in allocation for the Micro Enterprises Facility (MEF).

- Other Initiatives such as the Expansion of iTEKAD programme and Perlindungan Tenang Protection for B40.

ABM in its press release dated 6 November 2020, also announced that the enhanced targeted repayment assistance will be available to B40 borrowers who are recipients of Bantuan Sara Hidup (BSH) / Bantuan Prihatin Rakyat (BPR) and microenterprises with loans where the original facility amount is up to RM150,000. Under this enhanced targeted repayment assistance, eligible borrowers will be offered two options to choose from, i.e. either a 3-month deferment of instalment or a 6-month reduction in instalments by 50%3.

Each eligible borrower can only take up one of the above options under this enhanced targeted repayment assistance for each loan, from 1 December 2020 until 30 June 2021. Only loans that were approved before 1 October 2020 and are not in arrears exceeding 90 days as at date of request by the borrower would be eligible for this enhanced targeted repayment assistance. For married couples who are eligible for BSH/BPR based on household income, both husband and wife would be eligible for this package if they have bank loans. This enhanced targeted repayment assistance will be available to eligible borrowers between 23 November 2020 and 30 June 2021. The enhanced targeted repayment assistance will be available for instalments due in December 2020 onwards, and will take effect at the next instalment following a borrower’s request and confirmation.

All borrowers, regardless of whether they are recipients of BSH/BPR, categorized as M40 who are registered in the BPN database or not, who wish to discuss their financial repayment options with their banks and obtain advice on the targeted repayment assistance options available to them are welcome to contact their banks at any time, via their banks’ various official channels (e.g. the banks’ websites, branches, customer service hotlines).

To request for this assistance, eligible borrowers will only need to confirm their repayment option with their bank. Additional documentation from borrowers is not required by banks to obtain repayment assistance.

26 November 2020 - During Finance Minister Tengku Dato’ Sri Zafrul Tengku Abdul Aziz’s winding-up speech on Budget 2021 in Parliament, he announced that more than 700,000 Malaysians had applied for the second moratorium phase, now under Budget 2021, with some 98% of applications approved. He added that the government will be consulting with banks moving forward, and that the government is committed to helping the people if the situation worsens due to the Covid-19 pandemic4.

1 December 2020 – BNM issued press release (New and enhanced financing facilities for SMEs affected by COVID-19) to provide further information on the implementation of two funds, namely TRRF and MEF, as announced in the Budget 2021 speech by the Minister of Finance5.

15 December 2020 – BNM issued press release (Establishment of RM1 billion High Tech Facility – National Investment Aspirations [HTF-NIA]) on the detail features of HTF-NIA to provide additional assistance for SMEs affected by COVID-19. This facility is aimed at supporting high-tech and innovation-driven SMEs affected by COVID-19 to recover and revitalise the nation’s innovation capacity. This is critical to strengthen Malaysia’s competitive positioning in global value chains, preserve the supply chain ecosystem and safeguard high-skilled jobs6.

17 January 2021 – ABM issued press release (Banks continue to offer repayment assistance to borrowers/customers) that the banking industry will continue to extend the targeted repayment assistance to individuals who have been affected by the current MCO in light of the reintroduction of the MCO in a number of states and Federal Territories7.

18 January 2021 – In the Prime Minister’s Special Announcement on "Perlindungan Ekonomi dan Rakyat Malaysia" (PERMAI) Assistance Package, Tan Sri Muhyiddin Yassin said that to-date, more than 1.3 million borrowers have applied for and received the repayment assistance, with an approval rate of 95 per cent for individual borrowers and 99 per cent for SME borrowers8.

5 February 2021 - BNM announced in its press release an additional allocation of RM2 billion has been made for the Targeted Relief and Recovery Facility (TRRF) thereby increasing the total allocation of the facility to RM4 billion. TRRF will be available until 31 December 2021 or until full utilisation, whichever is earlier. SMEs that are recipients of the Special Relief Facility and PENJANA SME Financing are also now eligible to apply for TRRF, subject to a total financing limit not exceeding RM500,000. For SMEs in the tourism and tourism-related services subsectors, assistance remains available under the existing PENJANA Tourism Financing9.

Based on BNM’s website, as at 21 March 2021, 1.6 million applications have been received, with 95% of applications approved. 56% of the applicants approved were granted an extension on the moratorium and 46% received a reduction in their instalments10.

1 June 2021 - In a press conference regarding the latest federal government stimulus package under the Supplementary Strategic Programme to Empower the People and Economy (PEMERKASA+), Minister of Finance Tengku Datuk Seri Utama Zafrul Tengku Abdul Aziz stated that MCO 3.0 is the first of three phases to be enforced by the government as Malaysia entered its latest lockdown from June 1 to June 14 to address the surge of COVID-19 cases in the country. He said that as stated by the prime minister, the country will move into different phases of the MCO in stages, based on the risk assessment by the Ministry of Health11.

On 1 June 2021 ABM announced an expanded TRA programme covering all SME businesses that are not permitted to operate during the movement restrictions as announced by the Malaysian National Security Council (MKN) as well as the existing categories of borrowers comprising individual customers who have lost their employment, B40 borrowers registered under BSH/BPR and microenterprises with loan facilities of not more than RM150,000. All these affected borrowers may opt for a loan deferment for a period of 3 months; or a 50% reduction in their monthly instalment payment for a period of 6 months. ABM added that the affected borrowers who wished to avail of the TRA only need to contact their respective banks and indicate which option they want to choose and banks will automatically approve the selection made by borrowers that fulfill the criteria. Other affected borrowers that have experienced a reduction in income (including household income) are eligible for a commensurate reduction in monthly instalments. ABM member banks have in place bespoke/customised rescheduling and restructuring schemes to help alleviate the burden for their customers and have simplified the process for TRA as they are committed to making it convenient for borrowers to opt for the assistance package they need12. ABM reiterated in their press release dated 11 June 2021 that all affected individual borrowers from B40, M20 and T20 groups as well as micro SME’s & SME’s affected by the movement restrictions can also avail themselves to the repayment assistance offered as described above. The repayment assistance programme is offered to assist all borrowers affected by the pandemic and also ensure that the financial system remains resilient and the country is on the right path of economic recovery13.

Based on a press release made by BNM on 2 July 2021, the RM4 billion TRRF facility will be upsized by another RM2 billion to RM6 billion to provide relief for and support the recovery of SMEs in the services sector14.

On 29 October 2021, following the Budget 2022 announcement, BNM announced enhancements to its Funds for SMEs. These enhancements include a further RM2 billion allocation for the TRRF, bringing the total allocation to RM8 billion. Overall, additional assistance for SMEs under Budget 2022 have been made bringing the increase in allocation under the BNM's Fund for SMEs to RM4.5 billion, and the total funds available for SMEs as at mid-September 2021 to RM11.2 billion.15

1https://www.parlimen.gov.my/files/hindex/pdf/DR-06112020.pdf

2https://www.bnm.gov.my/-/budget-measures-to-assist-individuals-and-smes-affected-by-covid-1

3https://www.abm.org.my/media-room/press-releases/item/648-enhancements-to-the-targeted-repayment-assistance

4https://www.parlimen.gov.my/hansard-dewan-rakyat.html?uweb=dr&

5https://www.bnm.gov.my/-/new-and-enhanced-financing-facilities-for-smes-affected-by-covid-19

6https://www.bnm.gov.my/-/establishment-of-rm1-billion-high-tech-facility-national-investment-aspirations-htf-nia-1

7https://www.abm.org.my/media-room/press-releases

8https://www.pmo.gov.my/2021/01/special-announcement-on-the-perlindungan-ekonomi-rakyat-malaysia-permai-assistance-package/

9https://www.bnm.gov.my/-/trrf-drf-enhancement-2021

10https://www.bnm.gov.my/o/covid-19/tra_en.html

11https://www.theedgemarkets.com/article/zafrul-mco-30-first-three-phases-combat-covid19

12https://www.abm.org.my/media-room/press-releases/item/1082-banks-offer-loan-repayment-assistance-to-borrowers-affected-by-mco-3-0

13https://www.abm.org.my/media-room/press-releases/item/1121-banks-reaffirm-commitment-to-provide-financial-relief-assistance-to-all-affected-individuals-and-businesses

14https://www.bnm.gov.my/-/enhancements-to-facilities-under-bnm-fund-for-smes

15https://www.bnm.gov.my/-/additional-assistance-budget-2022

The blanket loan moratorium expired on 30 September 2020 and banks in Malaysia moved into the next phase by offering targeted repayment assistance. Banks in Malaysia continued to encourage affected borrowers to contact them to discuss financial assistance measures available to them. In addition, banks in Malaysia actively reached out to potential affected borrowers on the financial assistance that could be offered post 30 September 2020.

As the economy began to recover from the impact of the pandemic, banks in Malaysia focused on targeted assistance approach to households and businesses based on their financial circumstances and challenges.

During the Prime Minister’s announcement on 29 July 2020 regarding the extension of moratorium and banks’ targeted assistance, there was an increased number of individual borrowers who continued to repay loan installments and opt-out of the moratorium facility to 601,000 in July 2020 from 331,000 in April 2020 while the number of SME borrowers, who chose not to take this facility, increased to 13,000 in July 2020 from 5,000 in the same period1. It is worth to note that not everyone was affected by the resumption of loan repayments as most working Malaysians remain employed. This is further supported by the information obtained from the Department of Statistics Malaysia in which about 95.3 per cent of the total labour force was employed as of end July 2020, where 15.07 million persons were employed2.

30 July 2020 - As announced in the press release issued by ABM, repayment assistance was available for borrowers adversely affected by the COVID-19 pandemic upon the expiry of the blanket moratorium on 30 September 20203. Under the targeted repayment assistance measures, conventional banks were to provide additional assistance post 30 September, specifically for individual borrowers who had lost their jobs in 2020 and to those individual borrowers who were suffering from a drop in income due to the COVID-19 pandemic (collectively known as the “Severely Affected Categories”). The additional specific assistance provided was as follows:

- Individual borrowers who lost their jobs in 2020 and had yet to find a job could apply to their banks for an extension of the loan moratorium for a further 3 months; and

- Individual borrowers who were still in employment but whose income had been affected due to the COVID-19 pandemic (e.g. as a result of reduced working hours, pay cuts, etc.) could contact their banks to change the terms of their financing facility so that the monthly instalment would be commensurately reduced for at least 6 months from 1 October 2020, depending on the type of loan/financing.

For hire purchase financing, affected borrowers were offered revised instalment schedules that are consistent with the Hire Purchase Act 1967. In addition, assistance was also available for affected borrowers who did not fall within the Severely Affected Categories stated above.

In this regard, borrowers who required further assistance after the blanket moratorium ended were urged to contact their banks to discuss the repayment assistance options suited to their circumstances as early as possible. Banks were to assist affected borrowers in a more targeted, case-by-case approach to enable banks to focus on supporting those in real need of assistance whilst also supporting the country’s economic recovery. The affected borrowers may include, but were not limited to SMEs, corporates and other individuals, who were still facing difficulties with their loan/financing repayments and cash flow problems arising from the COVID-19 pandemic. Examples of such repayment assistance included payment of interest/profit only for selected products for a specified period, possible extension of the loan/financing tenure to enable lower monthly instalments and amending other terms and conditions of the loan/financing where appropriate.

9 September 2020 - BNM announced that it was conducting an online survey of applicants of targeted repayment assistance. The survey was to be used to inform its understanding of banking consumer experiences in discussing assistance needs during this challenging period. The survey was to be taken by individuals or SMEs, with the relevant links provided in BNM’s website4.

30 September 2020 - According to the ABM’s press release, in line with its commitment to support affected borrowers, the banking industry had adopted a simplified application and documentation process for targeted repayment assistance. The banking industry was cognizant that while the economy was recovering, many borrowers were still finding their footing and reorienting themselves amid new realities and uncertainties. If repayment obligations were to become a challenge in the coming months, borrowers were assured that the window to discuss alternative repayment arrangements would remain open6.

Individual banks directly engaged over 2 million borrowers through calls, emails and SMS to offer repayment assistance. According to BNM, there continued to be a steady increase in borrowers choosing to resume payment of their monthly instalments. BNM highlighted that applications for repayment assistance at any time before 30 June 2021 would not appear on a borrower’s CCRIS records7. Banks also assured borrowers that acceptance of the targeted extension of the moratorium and repayment flexibilities during the period would not appear in the CCRIS reports of individuals and SMEs.

19 October 2020 - BNM in its press release stated that borrowers who declined repayment assistance for now would still be able to apply for targeted assistance throughout 2020 and into 2021 if their financial circumstances changed in the future. BNM said that a targeted approach to repayment assistance extended relief measures more sustainably, while lending strength to the economic recovery. As banks have been entrusted by the public to manage their savings, the public, as depositors, expect that banks discharge their fiduciary obligation by managing these funds prudently and using them to provide loans to the economy for productive purposes. In addition, banks source capital from institutional funds, such as those managing the pensions, retirement funds and investments of Malaysians. It is therefore important to preserve a healthy credit culture where borrowers who can afford to repay do so8.

1https://www.pmo.gov.my/2020/07/teks-ucapan-pengumuman-lanjutan-moratorium-bantuan-bank-bersasar/

2https://www.dosm.gov.my/v1/index.php?r=column/cthemeByCat&cat=124&bul_id=Qm82anlxSkxvRDJEWkQyZUJaQ0tDZz09&menu_id=Tm8zcnRjdVRNWWlpWjRlbmtlaDk1UT09

3https://www.abm.org.my/media-room/press-releases/item/326-joint-press-release-by-abm-and-aibim-banks-to-provide-repayment-flexibility-to-borrowers-customers-affected-by-covid-19

4https://www.bnm.gov.my/-/bnm-invites-applicants-feedback-on-targeted-repayment-assistance

5https://pre2020.treasury.gov.my/

6https://www.abm.org.my/media-room/press-releases/item/526-joint-press-release-by-abm-and-aibim-repayment-assistance-banks-continue-commitment-to-assist-affected-borrowers-customers

7https://www.bnm.gov.my/-/transition-to-targeted-repayment-assistance

8https://www.bnm.gov.my/-/targeted-repayment-assistance-better-serves-borrowers-needs

25 March 2020 – BNM announced a number of regulatory and supervisory measures in support of efforts by banking institutions to assist individuals, SMEs and corporations to manage the impact of the COVID-19 outbreak. These measures allowed banking institutions to remain focused on supporting the economy during these exceptional and unprecedented circumstances, by providing flexibilities for banking institutions to respond swiftly to the needs of their borrowers. Amongst others, the deferment of all loan repayments for a period of 6 months, with effect from 1 April 2020. This offer was applicable to performing loans, denominated in Malaysian Ringgit, that had not been in arrears for more than 90 days as at 1 April 2020.

For credit card facilities, banking institutions offered to convert the outstanding balances into a 3-year term loan with reduced interest rates to help borrowers better manage their debt1. The deferment targeted only deserving borrowers who were challenged financially in the short-term. Thus, the blanket moratorium granted was not for those who had already defaulted before the COVID-19 impact and took advantage of the same.

In context, it was a temporary deferment or suspension of loan payment obligation (principal and interest) for a limited period of time, not a waiver. During this period, borrowers with loan that met the eligibility conditions did not need to make any payment, and no late payment charges were imposed. Borrowers, however, needed to honour the deferred payments in the future as loan/financing repayment would resume after the deferment period.

The blanket moratorium was meant to ease cash flows for borrowers who were affected by the COVID-19 pandemic. It was to help individuals and businesses facing financial adversities cope with challenges during this period. As was highlighted in BNM’s announcement on 25 March, borrowers were advised that interest will continue to accrue on deferred payments and they should consider this when deciding whether they wish to take up the moratorium as borrowers would need to honour the deferred repayments in the future1. Borrowers were advised to ensure that they understood and discussed with their banking institutions on the options available to resume their scheduled repayments after the deferment period.

Malaysia is one of the few countries in the world to implement an automatic moratorium for 6 months from April 2020 for the benefit of individuals and SMEs during the enforcement of the MCO to combat the spread of COVID-19. For Malaysia, all individuals and SME/loan financing that meet the stipulated criteria will automatically qualify for the deferment. According to Moody’s Investors Service, Malaysia offered the most extensive loan moratorium in South-East Asia, covering about 80 per cent of total loans2. Under the 20th report by the Economic Stimulus Implementation & Coordination Unit Between National Agencies (LAKSANA), Finance Minister Tengku Dato’ Sri Zafrul Tengku Abdul Aziz said that a total of 732,000 borrowers who took the automatic moratorium have resumed their monthly loan repayment instalments and under the 24th LAKSANA report he said that the value of the moratorium as of 25 September 2020 is estimated at RM97.26 billion. Out of this figure, a total of RM34.04 billion was utilised by the business sector while RM63.22 billion was utilised by the Rakyat3. Overall, the moratorium benefited more than 7.7 million Malaysians, comprising 93 per cent of individual borrowers as well as 243,000 businesses or 95 per cent SMEs4.

1https://www.bnm.gov.my/-/measures-to-assist-individuals-smes-and-corporates-affected-by-covid-19

2https://www.thestar.com.my/business/business-news/2020/07/18/honeymoon-over-for-borrowers

3https://pre2020.treasury.gov.my/

4https://www.parlimen.gov.my/files/hindex/pdf/DR-27072020.pdf

WHAT OTHER MEASURES HAVE BEEN TAKEN?

Apart from the measures and assistance being provided by the banking institutions, there are various other initiatives made by the Malaysian government, BNM and other industries to aid those who are financially affected by the COVID-19 pandemic.

The initial assistance given were the PRIHATIN and PENJANA economic stimulus package amounting to RM295 billion1 by the Malaysian government

The Prime Minister had on 5 June 2020 announced that measures under PRIHATIN Rakyat Economic Stimulus Package have saved over 2.4 million jobs, while over 10 million people received assistance to ease their cash flow burden, and over 300,000 companies supported. Under PRIHATIN, RM7 billion in financing to help SMEs was provided through BNM and financial institutions. These include the following2:-

- Special Relief Facility (SRF);

- Agrofood Facility (AF);

- Automation and Digitalisation Facility (ADF); as well as

- Micro credit schemes

Additionally, the Ministry of Tourism, Arts and Culture (MoTAC) had on 30 July 2020 announced the PENJANA Tourism Financing (PTF) Scheme to aid the tourism sector. According to the ABM’s press release dated 6 August 2020, the PTF which is offered by 12 participating banks in Malaysia, is aimed at supporting Malaysian micro, small and medium enterprises (MSMEs) in the tourism sector by preserving their capacity and assisting them to adjust and remain viable post COVID-19, can be utilised for working capital and capital expenditure to enhance their business models and deploy new practices3. Minister of MOTAC, Datuk Seri Nancy Shukri has urged tourism players to apply for the PTF worth RM1 billion to remain competitive in the new normal during the COVID-19 pandemic4.To support the tourism sector until 30 June 2021, service tax exemptions for hotels that have been utilised by accommodation premises operators has reached a value of RM1.37 billion. Other initiatives to support the tourism sector include individual income tax relief of up to RM1,000 on travel expenses, as well as full tourism tax exemption5. As of 31 December 2021, there were 701 applications for PTF, of which 340 applications had been approved with a total financing of RM67.5 million6.

As of 3 November 2020, a total of RM9.86 million people have benefited from RM4.5 billion channelled under the Bantuan Prihatin Nasional (BPN) 2.0, which includes 7 million from the B40 group and 2.86 million recipients from the M40 group7.

On 9 December 2020, Finance Minister Tengku Dato’ Sri Zafrul Tengku Abdul Aziz said that various government agencies will continue to provide soft loans and grants, including through Budget 2021, to ensure that SMEs receive support, operate smoothly and grow. The government hopes that all this support will enable the SMEs to compete in the medium and long terms. He highlighted that about 1.4 million SMEs and micro-SMEs have already benefitted from the various assistance amounting to over RM24 billion under the stimulus packages8.

On 14 January 2021, Tengku Dato’ Sri Zafrul Tengku Abdul Aziz said that the government has disbursed a total of RM1.149 billion in financing to SMEs as of 1 January 2021, under the short-term National Economic Recovery Plan (PENJANA)9.

On 18 January 2021, Prime Minister Tan Sri Muhyiddin Yassin announced the "Perlindungan Ekonomi dan Rakyat Malaysia" (PERMAI) assistance package worth RM15 billion. In a special address, Prime Minister said a total of 22 initiatives will be implemented under PERMAI, anchored on three main objectives namely - Combating the Covid-19 outbreak, safeguarding the welfare of the people, and supporting the business continuity10.

BNM in its press release dated 17 March 2021 announced that an additional allocation of RM700 million has been provided for the SME ADF, bringing the facility’s total size to RM1 billion. The ADF, which was established in March 2020, aims to encourage SMEs across sectors to automate processes and digitalise operations to increase productivity and efficiency. The facility will be available until 31 December 2021 or full utilisation, whichever is earlier11.

For the SME Soft Loans Funds administered by BNM as at 31 December 2021, the total approved applications by local banks and accepted by SMEs is RM12.59 billion, which will benefit 26,369 SMEs; amount includes SRF (which has been fully utilized by 21,000 SMEs and has helped save over 400,000 jobs12), ADF, All-Economic Sector Facility and AF funds6. In supporting business continuity the TEKUN Business Recovery Scheme (TBRS), specifically for Micro SMEs has benefited 14,946 micro businesses, fully utilizing its RM100 million fund5. The government's allocation of RM2 billion under PENJANA SME Financing which prioritises SMEs that have never obtained any bank loans before has also disbursed as at 21 May 2021, a total of RM1.403 billion in financing to SMEs benefitting 7,497applicants13.

1https://www.thestar.com.my/news/nation/2020/08/06/ministry-studying-efficacy-of-stimulus-measures

2https://www.thestar.com.my/news/nation/2020/06/05/pm-unveils-short-term-recovery-plan-to-boost economy

3https://www.abm.org.my/media-room/press-releases/item/336-joint-press-release-by-abm-adfim-and-aibim-penjana-tourism-financing-for-smes-and-micro-enterprises-open-for-application-at-participating-banks

4https://pre2020.treasury.gov.my/flipbook/laksana15/

5https://pre2020.treasury.gov.my/pdf/Teks-Ucapan-Laporan-LAKSANA-PRIHATIN-44.pdf

6https://www.mof.gov.my/portal/pdf/laporan-laksana/laksana-81/

7https://pre2020.treasury.gov.my/pdf/Teks-Ucapan-Laporan-LAKSANA-PRIHATIN-28.pdf

8https://themalaysianreserve.com/2020/12/10/tengku-zafrul-loans-grants-for-smes-to-continue/

9https://pre2020.treasury.gov.my/pdf/Teks-Ucapan-Laporan-LAKSANA-PRIHATIN-36.pdf

10https://www.pmo.gov.my/2021/01/special-announcement-on-the-perlindungan-ekonomi-rakyat-malaysia-permai-assistance-package/

11https://www.bnm.gov.my/-/additional-allocation-rm700-million-sme-adf

12https://pre2020.treasury.gov.my/pdf/Teks-Ucapan-Laporan-LAKSANA-PRIHATIN-19.pdf

13https://pre2020.treasury.gov.my/flipbook/laksana55/

In their continual support of the economic recovery process, the government launched the Strategic Programme to Empower the People and Economy or PEMERKASA worth RM20 billion, along with a new fiscal injection amounting to RM11 billion on Wednesday 17 March 2021. Prime Minister Tan Sri Muhyiddin Yassin said PEMERKASA would focus on 20 strategic initiatives to boost economic growth, support business, and continue targeted assistance to the people and sectors that are still affected. With the inclusion of PEMERKASA (RM20 billion), the total value of the government aid packages amounted to RM340 billion1.

On 31 May 2021, Prime Minister Tan Sri Muhyiddin Yassin said in a special address that a number of initiatives would be implemented under the Supplementary Strategic Programme to Empower the People and Economy (PEMERKASA+). The RM40 billion aid package is anchored under three main objectives which are:

(i) to increase public healthcare capacity

(ii) continue the welfare agenda for the people, and

(iii) support business continuity

He went on to announce that the banks initiative of providing the option of 3 month bank moratorium or a 50% reduction in loan repayment for six months to all B40 borrowers registered under the BSH/BPR, those who lost their jobs as well as SMEs who are not allowed to operate during the movement control order is worth RM30 billion and benefits approximately 5 million borrowers2.

1https://www.pmo.gov.my/2021/03/pemerkasa-worth-rm20-bln-launched-along-with-rm11-bln-fiscal-injection-from-govt-pm-muhyiddin/

2https://www.thestar.com.my/news/nation/2021/05/31/pm-announces-pemerkasa-plus-aid-package-worth-rm40bil

In the government’s next step to mitigate the impacts of a continued lockdown, the Prime Minister announced RM150 billion in COVID-19 relief spending on 28 June 20211.

During the Ministers briefing session at the Special Meeting of the Third Session of the 14th Parliament on 26 July 2021, Prime Minister Tan Sri Muhyiddin Yassin said that in supporting businesses, government guarantees will be increased to RM20 billion for SME financing and funds for new SME loans worth RM4 billion will also be provided. He added that as of end-June 2021, there remains an overall balance for SME financing facility of RM8.6 billion that can be utilised by SMEs2.

1https://www.malaymail.com/news/malaysia/2021/06/28/pm-muhyiddin-announces-rm150b-pemulih-package-as-additional-stimulus-to-fue/1985609

2https://www.parlimen.gov.my/hansard-dewan-rakyat.html?uweb=dr&

As reported in the BNM’s Annual Report 2020 released on 31 March 2021, it has worked closely with AKPK, the banking associations and banks to support the implementation of the automatic loan moratorium and the Targeted Repayment Assistance (TRA) programme by providing information and advice to affected borrowers. Engagements with stakeholders were key in implementing its policies to mitigate the wide-ranging effects of the pandemic. Hence BNM intensified its outreach efforts to members of the public, financial institutions, the business community and various stakeholders through virtual meetings, webinars, engagement sessions, print, digital and social media platforms. Through these, BNM was able to respond to the needs of the public for information, especially to help individuals and businesses manage their financial circumstances through a highly challenging period1.

The “Seek Help Early” campaign was launched to encourage affected borrowers to discuss their financial obligations with their financial service providers. In total, more than 150 awareness programmes were conducted on TRA that helped more than 1.2 million borrowers manage their loan repayments. According to BNM, print and electronic media played an important role in the dissemination of information on the automatic moratorium, TRA and the SME financing facilities. BNM spoke at more than 17 programmes on regional radio stations, reaching out to more than 400,000 listeners and worked with several television stations to run a series of public service announcements on the TRA. In addition, BNM worked with government agencies, regulators and telecommunication companies to create awareness and address the misconceptions on the moratorium and TRA via public service announcements (SMS blasts) to a total of 43 million subscribers1.

According to BNM in the same report, banks have adopted new approaches to render COVID-19 repayment assistance as efficiently as possible, without compromising on robust governance and risk management standards. Roughly eight million individual borrowers and 250,000 SMEs benefited from the 6 months automatic moratorium while the larger corporates receive supports via restructuring and rescheduling of their loans/financing. As for repayment assistance, 1.3 million applications were received and 95% of the same were approved and valued at RM204 billion. By 31 December 2020, 95% of retail borrowers and 85% of SME borrowers were able to resume their payments. This is due to the gradual resumption in economic activities where borrowers would have different financial needs and the targeted assistance enabled borrowers to receive continued help based on their specific financial circumstances. Borrowers that could afford to repay their loans/financing were encouraged to do so in order to reduce overall borrowing costs. At the same time, borrowers were also assured that if their financial circumstances change as a result of further shocks due to the pandemic, they could still seek help in future, without affecting their credit records in the CCRIS2.

An important focus during the year 2020 was ensuring continued access to finance for SMEs under highly challenging business conditions. To help SMEs to weather the pandemic, BNM significantly increased the allocation of financing assistance under BNM’s Fund for SMEs (BNM’s Fund) from RM9.1 billion to RM23.1 billion. Facilities under BNM’s Fund, channeled through the financial institutions, aimed to provide immediate cash relief to adversely affected SMEs, support recovery of hard-hit economic sectors and enhance innovative capacity of high-tech SMEs. BNM’s Fund complements the much larger provision of SME financing by the financial institutions, which disbursed a total of RM256.8 billion in loans/financing to SMEs in 2020, with more accounts approved compared to the previous year (2020: 145,993 accounts; 2019: 115,498 accounts). BNM’s Fund has helped to sustain businesses and safeguard jobs, with about RM6.0 billion worth of funds still available for new applications by SMEs as at mid-March 2021. Funds by BNM has benefitted more than 32,000 SMEs and supported around 596,600 jobs. Beyond the provision of funds, BNM also supported the availability of credit guarantee schemes to encourage continued bank lending in the heightened risk environment3.

On 29 October 2021, BNM announced in their press release that two new facilities will be made available from January 2022. The first is a RM1 billion Business Recapitalisation Facility (BRF) created to strengthen the capital structures of businesses and help businesses seek financing while better managing more sustainable indebtedness levels. The second new facility is a RM1 billion Low Carbon Transition Facility (LCTF) which will be established on a matching basis by participating financial institutions to help SMEs embrace sustainable and low carbon practices in their business operations4.

1https://www.imf.org/en/Publications/Miscellaneous-Publication-Other/Issues/2020/05/20/COVID-19-The-Regulatory-and-Supervisory-Implications-for-the-Banking-Sector-49452

2https://www.bnm.gov.my/documents/20124/1395181/ch1.pdf

3https://www.nama.com.my/PRINT_NEWS/2021/02/12/20210212_N60_STR_BZ_1_FC_LENDING~ACTIVITIES~IMPROVING.JPG

4https://www.bnm.gov.my/-/additional-assistance-budget-2022

HOW HAVE OTHER REGIONS BEEN IMPACTED?

Financial institutions (FIs) worldwide including Malaysia have been proactive in responding to the needs of their borrowers with various rescheduling and restructuring initiatives offered to assist affected borrowers. Such efforts are highly commended and encouraged to continue. These assistances would be subject to independent assessment by the banks on a case-to-case basis. The deferment package arising from the COVID-19 pandemic in Malaysia has been an extension of these measures across all FIs to widen access to short-term financial relief by households and businesses that need it the most in these challenging times.

In other countries, certain conditions have to be met first in order for the borrowers to qualify for the moratorium amid the coronavirus (COVID-19) crisis and a period of 6 months loan deferment is typical e.g. countries such as Australia, New Zealand and India have also granted 6 months loan deferment. BNP Paribas Asset Management Malaysia Sdn Bhd Chief Executive Officer (CEO) and Country Head, Angelia Chin-Sharpe said compared with regional peers, moratorium support offered by Thailand’s banks only covered 33 per cent of the country’s total loan book, followed by the Philippines (22 per cent), Indonesia (16 per cent), India (11 per cent) and Singapore (10 per cent) while Malaysian banks are the most committed to helping businesses and individuals wade through the COVID-19 crisis with up to 55 per cent of the total loan book for banks in the country are under moratorium1.

Despite the various measures offered, it is worth to note that according to Maybank Kim Eng Research, loan moratoriums and restructuring pose critical risks to the banking systems in ASEAN including Malaysia and need to be watched going forward because even if 10% of such loans are going bad, this could have a material impact on non-performing loans (NPLs) especially in Indonesia, Thailand and Malaysia, as well as in Singapore and the Philippines. These loans are not classified as NPLs, hence leads to a shadow asset quality risk and muddied the waters on asset quality risks. The research house reiterated that this is a critical risk that needs to be closely watched2.

1https://www.ukfinance.org.uk/press/press-releases/uk-finance-and-building-societies-association-respond-financial-conduct-authority-announcement

2https://www.thestar.com.my/business/business-news/2021/02/04/moratoriums-pose-risks-to-banking-systems-in-asean

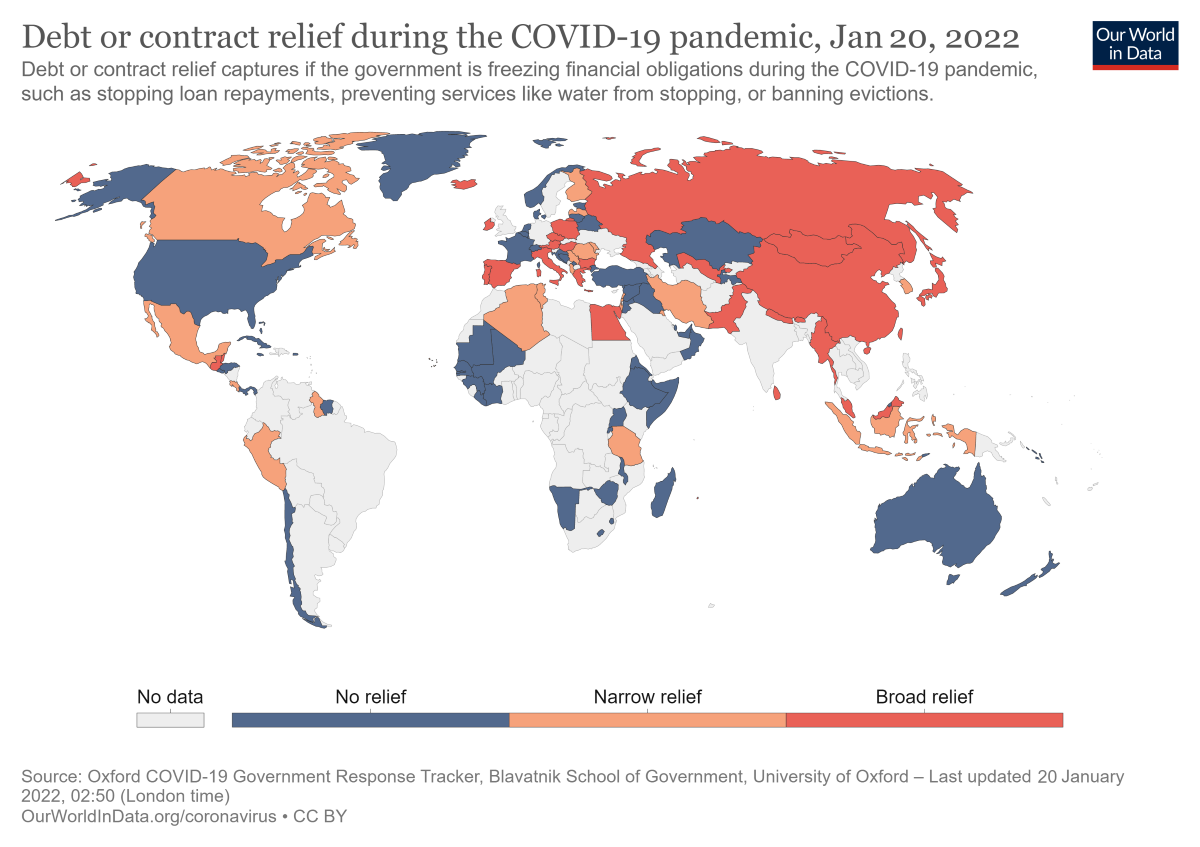

WORLD MAP OF DEBT OR CONTRACT RELIEF MEASURES

The map below serves as a guide to the debt or contract relief measures made by governments around the world during the COVID- 19 pandemic as at 20 January 2022. While the visual representation is not limited specifically to loan deferment assistance, it is a useful indicator in seeing the broad fiscal and financial measures made by governments in response to the pandemic.

In 2021, the eight economic packages worth RM530 billion offered by the Malaysian government was one of the largest in the world1. According to the Organisation for Economic Cooperation and Development (OECD), Malaysia’s past prudence has allowed it to react boldly in fiscal policy with a series of relief packages amounting to more than 35% of its gross domestic product. The move they said has been well targeted and its implementation has been swift thanks to an established distribution system. OECD also reported that Malaysia’s massive moratorium programmes have alleviated the financial distress of affected households and businesses2.

According to a report made by the Unit for the Implementation and Coordination of National Agencies on the Economic Stimulus Package (LAKSANA), Malaysia’s Covid-19 stimulus packages contributed 20 per cent to the country’s gross domestic product (GDP), comparable to other developed countries and higher than regional developing countries.

The analysis compared Malaysia against countries in the Asia Pacific region (Indonesia, Philippines, Singapore, Thailand, Vietnam, Australia, New Zealand, China, Taiwan, South Korea) and the United Kingdom and United States of America. It reported that in the US, the stimulus packages contributed 26.5 per cent to GDP, New Zealand 19.3 per cent, Australia 19.1 per cent and the UK 17.8 per cent. As for the Asian region, it reported that Malaysia is on par with Singapore at 20 per cent as well, while other countries such as China, Thailand, Vietnam and Taiwan contributed below 10 per cent to their GDP33.

1https://www.nama.com.my/PRINT_NEWS/2021/08/06/20210806_N60_BRH_NA_7_FC_PAKEJ~BANTUAN~MALAYSIA~ANTARA~TERBESAR~DI~DUNIA.JPG

2https://www.nama.com.my/PRINT_NEWS/2021/08/13/20210813_N60_SUN_BZ_11_BW_OECD~MALAYSIAS~MACRO~FISCAL~POLICIES~SHOULD~REMAIN~SUPPORTIVE~OF~ECONOMY.JPG

3https://www.malaymail.com/news/malaysia/2021/07/18/malaysias-covid-19-stimulus-packages-on-par-with-those-in-developed-countri/1990809

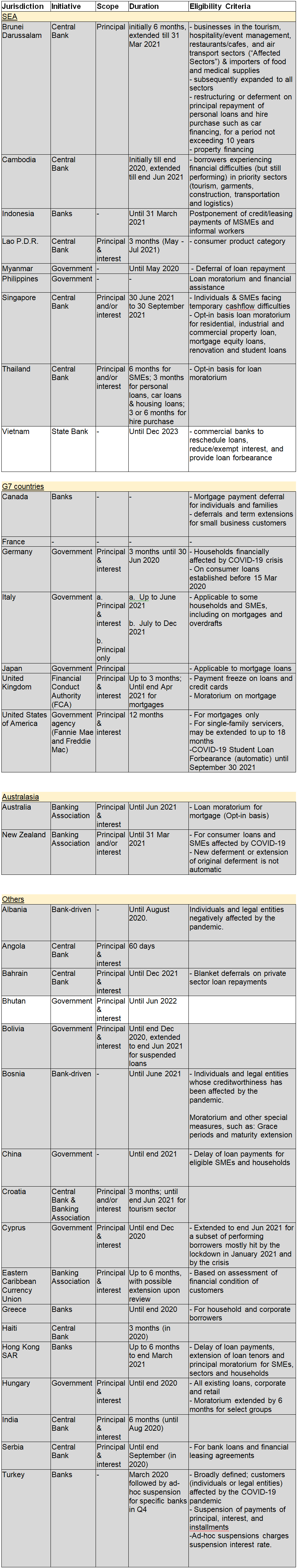

A QUICK REFERENCE GUIDE ON THE LOAN DEFERMENT ASSISTANCE OFFERED IN OTHER COUNTRIES

The table below provides a collective overview of the different types of loan deferment assistance provided in other countries to aid individuals and business owners in mitigating the financial impact of the coronavirus pandemic. Many countries around the world provided similar assistance to that offered in Malaysia, however, unlike Malaysia the assistance that was provided before in these countries were deemed sufficient and most are no longer available at the time of writing.

The areas highlighted in grey are countries where the provision of financial assistance and aid is no longer available.

Similar to banks in Malaysia, banks in Australia have urged their borrowers to talk to their bank(s) if they are still struggling with finances, and not to wait further. CEO Anna Bligh of the Australian Banking Association (ABA) also added that banks are there to lend money into the economy but they are also there to make sure that they lend that money with the appropriate degree of risk and the ability to manage that risk. This is important because the banks are lending the customer’s money, the money out of customer’s deposit account1.

In an interview on Money News with ABA CEO Anna Bligh on 11 March 2021, she explained that customers continue to come off deferrals and that out of six million people in Australia that have a mortgage,1% of them are experiencing some form of arrears. Anna Bligh reiterated that right at the height of COVID, when things were at their absolute worst, only 10% of Australian mortgage holders deferred the payments on those mortgages. 90% of those people are now back paying in full2.

ABA has stated in an announcement on 8 July 2021 that a national support package will be available to all small businesses and home loan customers significantly impacted by current lockdowns or recovery from recent lockdowns, irrespective of geography or industry. On application, this support also includes business banking repayment deferrals and home loan support3.

1https://www.ausbanking.org.au/news-resources/

2https://www.ausbanking.org.au/customers-continue-to-come-off-deferrals/

3https://www.ausbanking.org.au/australian-banks-offer-covid-19-customer-relief/

Roger Beaumont, CEO from the New Zealand Bankers Association stated in a press release dated 31 March 2021 that the number of deferred household and business loans have continued to decline through March. Hence this marks the end of the loan repayment deferral scheme introduced a year ago to help borrowers financially affected by the Covid-19 pandemic. At the end of February there were around 3000 household and business loans still deferred. Banks are working closely with the few affected customers who still need help to get back on track. Assistance for these customers will be tailored to their individual circumstances1.

1https://www.nzba.org.nz/2021/03/31/loan-repayment-deferral-scheme-ends-today/

Singapore imposes the condition that borrowers need to apply on an opt-in basis to their banks for the deferment (i.e. not on a blanket approval basis), as each individual’s financial situation is different1. During the Parliament Sitting on 16 February 2021, Mr Tharman Shanmugaratnam, Senior Minister and Minister in charge of the Monetary Authority of Singapore (MAS) explained that upon the expiry of the relief packages offered by financial institutions for borrowers to overcome financial difficulties due to the COVID-19 pandemic at the end of last year, extended reliefs have been made available to individuals and SMEs facing continued cashflow challenges. MAS and the financial industry will continue to monitor the situation closely. According to Mr. Tharman, other than a few hard-hit sectors such as aviation, the economy is generally recovering, and there should be fewer cases of financial hardship as so far, only a small proportion who took up reliefs in 2020 have sought the extended reliefs2.

As for Thailand, Mrs Roong Mallikamas, Assistant Governor, Financial Stability and Corporate Strategy Group, Bank of Thailand (BOT) in the press release dated 16 October 2020, updated that BOT has opted for an approach away from a traditional and generic measure to a proactive and more targeted approach as loan payment holiday under the Emergency Decree on Financial Assistance to Small and Medium-sized Enterprises Affected by Coronavirus Pandemic B.E. 2563 (2020) will end on 22 October 2020. It was stated the measure on loan payment holiday also has long-term negative consequences due to the following1:

- The loan payment holiday measure merely applies to a deferral of debt payment whereas interest charges continue to accrue during the holiday period. This interest payment obligation is a burden for borrowers in the long run.

- The measure creates moral hazard for borrowers that are in a position to continue servicing the loans. These borrowers may opportunistically decide not to service the loans.

- Continuation of the payment holiday poses risks to the stability of the financial institution system as financial institutions will not be able to book the regular cash inflows.

1https://www.bot.or.th/English/PressandSpeeches/Press/2020/Pages/n7363.aspx

UK Finance, the collective voice for the banking and finance industry, representing more than 250 firms across the industry, had on 21 October 2020 announced that as the furlough scheme comes to an end on 31 October 2020, the banking and finance industry is committed to providing tailored support to borrowers facing financial difficulty. According to UK Finance, it is always in a borrower’s best interest to resume payments if they are able to do so. Evolving industry analysis suggests that over three quarters of mortgage, personal loan and credit card customers whose payment deferral has come to an end have now returned to making repayments1.

UK Finance and Building Societies Association (BSA) respond to announcement of Financial Conduct Authority (FCA) consultation on mortgage payment deferrals that they will continue to work with the regulator on measures to support mortgage borrowers impacted by COVID-19 as follows1:

- UK Finance - Lenders are continuing to provide unprecedented levels of support to help borrowers through the COVID-19 crisis and have been working closely with the FCA to ensure that borrowers impacted by the new lockdown measures will be able to access the assistance they need, including being able to defer payments on their mortgages where this can help.

- BSA - For those with a mortgage, the best advice will always be to continue to pay if can, and to discuss any concerns early with the lender. For those who are having difficulties, a payment deferral for a total of 6 months followed by ongoing tailored support are available. Lenders are working hard to support their borrowers through this time.

1https://www.ukfinance.org.uk/covid-19-press-releases

HOW ARE BANKS IMPACTED?

According to a Joint IMF-World Bank Staff Position Note with an overview of measures taken across jurisdictions to date, in order to alleviate further operational pressure and burden on banks, many authorities have revised their enforcement approaches by putting on hold or postponed non-critical reporting and/or stress testing exercise1. However, banks are still required to implement enhanced credit monitoring approaches so that market discipline continues to play its critical role. Authorities have also recognized and exerted efforts to reduce moral hazard to promote transparency and risk disclosures by:

- making the measures time bound

- clearly defining the sectors and loans who are able to access these measures

- requiring additional reporting to facilitate banks in monitoring and assessment of the impact of the measures

By granting the moratorium, banks' liquidity coverage ratio (LCR) will decline more significantly as banks would still require working capital to continue paying for interest expense, meet deposit withdrawals, debt repayments and sustain its overheads. The loan deferment would also impact upon the banks’ cashflow as payments from their borrowers will not be forthcoming until 6 months later. However, if borrowers continue to face repayment/payment constraints after the 6 months blanket moratorium expires, higher default rates will start to show up on banks’ balance sheets and will be reflected as higher impaired loan provisions or credit cost.

In the Malaysia context, Finance Minister Tengku Dato’ Sri Zafrul Abdul Aziz said the banking sector is estimated to see losses of RM6.4 billion during the loan moratorium period, between April and September i.e. losses of approximately RM1.06 billion per month based on Malaysian Financial Reporting Standards (MFRS) 9. According to the Finance Minister, over the six-month blanket moratorium period, banks could incur RM79 billion loss in capacity to provide loans, otherwise known as “modification loss”2. “Modification loss” is the reduction in the banks’ capacity to disburse new loans worth RM79 billion to the borrowers i.e. individuals and businesses. This amount is the total that banks can lend individuals and businesses in a normal business situation over the six-month period.

According to BNM’s Financial Stability Review for First Half 2020, banks reported a marked decline in earnings from domestic banking activities during the first half of the year, weighed down by further margin compression and higher provision for credit losses. On a positive note, significant relief measures introduced have kept business loan impairment ratios low and stable at 2.5 per cent for overall non-financial corporates. Households continue to maintain comfortable levels of financial assets and liquid financial assets at 2.2 times and 1.4 times of debt, respectively, as relief measures introduced by the government and banks released extra cash to households. Business conditions are expected to improve in the second half of the year, in line with the gradual improvement in economic activity. The extension of targeted financial relief measures will continue to help support businesses alongside corporate and SMEs guarantee schemes as the recovery takes a stronger hold. Based on BNM’s statistics, since July, the number of businesses receiving repayment assistance from banks has increased seven-fold. In the first half of 2020, the banking system as a whole disbursed a total of RM120 billion in lending and financing to the SMEs with more accounts being approved in 2020 compared to the same period in previous years. BNM also revealed in its report that the local banks’ credit cost could rise to RM29 billion in 2020 and 2021 on the back of higher projected loan impairments3.

Overall, the local banking industry has experienced an extremely challenging year in 2020 as many banks are posting weaker performance to, among others, lower net interest income, significantly higher allowance for impaired loans amid a Covid-19 pandemic driven weaker economic outlook and the automatic loan modification loss.

According to BNM’s Governor Datuk Nor Shamsiah Mohd Yunus during the release of Malaysia’s fourth quarter 2020 gross domestic product results, for the first time since the COVID-19 outbreak, banks in Malaysia have been more willing to lend as the appetite for loans improved across household and businesses4. In the final quarter of 2020, business loan disbursements rose to RM206.2 billion, exceeding the 2017-2019 quarterly average of RM196.7 billion5.

In its base case, S&P Global Ratings expects that most banks in Asia-Pacific would absorb the hits from COVID-19 and start to recover by the end of 2021. Nevertheless, a more severe or prolonged hit to the economies than the current baseline would almost certainly push banks’ credit losses higher, drive their earnings lower and amplify other risks6. In a report on 6 Oct, Moody’s said it expect asset quality to deteriorate significantly in Asia-Pacific as economic conditions remain weak, while profitability will take a hit from rising credit costs and declining margins7 According to Fitch Ratings report dated 7 January 2021, rating outlooks had turned negative for banks in most jurisdictions this year compared to 2020. This reflected downside risks to its baseline scenario from a potentially sluggish economic recovery following sharp deterioration in 2020 owing to the pandemic. Fitch said the rating outlook for Malaysian banks was "negative", while the sector outlook was "stable". The key issues for Malaysian banks were slow non-performing loan recognition, lower profitability and property market risks, it added8.

Analysts and economists said that the banks’ gross impaired loans (GIL) could weigh on the banking sector as how the asset quality of banks would evolve will depend on the duration of the MCO 2.0 that is implemented by the government beginning 13 January 2021 to curb the pandemic. Rising GILs have always been the key risk factor under the present scenario, as this ratio has been inching upwards from 1.38% in September 2020 to 1.41% and 1.53% in October and November 2020 respectively9.

It is important to understand that banks’ primary role is to take in funds (in the form of deposits and shareholdings in the banks) from depositors, pool them, and lend them to those who need funds. In simple words, banks are intermediaries between depositors (who lend money to the bank) and borrowers (to whom the bank lends money). Ultimately it is our money in the form of deposits and our money in the form of shareholdings in the banks that is used to match up the creditors and borrowers. The performance of the credit sector plays an important role as a catalyst for economic growth today. Therefore, when the buffers deplete and loan demand weakens, banks would not be able to declare dividends as they will rely on retaining their earnings to strengthen their capital. With no dividends to be declared by the banks, it is not only the Top 20 per cent (T20) of the Malaysian population who will be affected, but Malaysians in general as well, who would receive less or even no benefits from their deposits which are in unit trust funds.

In an article written by Datuk Abdul Farid Alias (as he was then), Chairman of ABM, he explained that it was important for banks to remain financially sound as the profits made are retained as capital for lending and dividends to shareholders. A significant percentage of the banks’ equity are held by Malaysian institutional investors, hence, the profits made by these investors flow back to the public in the form of dividends for the people who depend on sustainable returns from these investments for their financial needs and retirement years (for example, ASB unit holders, EPF and Tabung Haji members and government pensioners). As for capital, he stated that if a bank is unable to grow its capital, it may have to slow down or even stop giving new loans. Banks need to be able to grow its capital to enable banks to give out loans in order to help the country to recover faster10.

With the announcement of another loan moratorium on 28 June 2021, the recognition of non-performing loans (NPL) into 2022 will be further delayed and may lengthen the time needed for banks' credit costs and profitability to revert to normal. According to Fitch Ratings their initial revised projection of the banking system's NPL ratio to rise only marginally by end-2021, from 1.6 per cent as of May 2021, is now expected to peak at below 2.5 per cent. The credit rating agency went on to explain that reduced visibility into customers' financial health and repayment behaviour may also give rise to heightened caution among banks and lower their appetite for loan growth11.

In the announcement of the Economic and Financial Developments in Malaysia in the Second Quarter of 2021 by BNM on 13 August 2021, bank financing to SMEs, complemented by BNM’s Fund, expanded to 6% as banks continue to drive the major share of the financing disbursed to SMEs. It was also reported that the high take-up of repayment assistance will help cushion impact from FMCO as the proportion of households and SMEs under repayment assistance remains manageable12.

BNM’s Governor Datuk Nor Shamsiah Mohd Yunus also stated in a press conference held on the same day that waiving the accrued interest payment on all individual and business loans during the current six-month moratorium will significantly impact banks and the country's long-term recovery from COVID-19. She explained that interest income accounts for 80 per cent of bank revenue and the total individual and SMEs loans eligible for automatic opt in moratorium is close to RM1.4 trillion, or around 73 per cent of the total banking system loans in the country. She explained that waiving accrued interest payment on these loans under the moratorium will have serious ramifications and given the banks critical role in the economy they must remain resilient to provide the financial assistance that borrowers require during this difficult time13.

The Minister of Finance has on 14 September 2021 issued a press statement stating that MOF has amongst others, instructed banks to work on the exemption of interest payments for recipients of the bank loan moratorium for B50 of Malaysians, for a period of three months in 4Q21 (from October until December)14.

BNM’s response on the interest payment waivers in an article published by The Edge Markets on 24 September 2021 has stressed that it is imperative that the short-term relief measures do not incur significant long-term damage to the economy. The regulator stated that banks will be affected by these measures to varying degrees depending on their size and profile of borrowers and highlighted that it is important to consider the effect of the waiver as it may result in financial year losses for some banks and affect future distributions to shareholders. BNM has added that it will continue to closely monitor the implementation of repayment assistance by banks that are already in place for borrowers in need15.

Similarly, an article published on 27 September 2021 calculates that the interest waiver will result in a short-term cash flow gain of less than RM120 per B50 household but estimates that the immediate losses for the banks will total RM2 billion to RM4 billion. It goes on to state that the call for an interest waiver is short-sighted and irrational both economically and mathematically speaking16.

With the announcement of the Financial Management and Resilience Programme (URUS) on 14 October 2021, Public Investment Bank Bhd (PublicInvest Research) stated that they expect rate normalisation in 2022 and anticipate economic recoveries will bring about asset quality improvements and loans growth for banks. They added in their review that they do not see conditions getting significantly worse than 2020 levels17.

1https://www.bnm.gov.my/documents/20124/2294076/4Q2020_GDP_Slides.pdf

2https://www.parlimen.gov.my/files/hindex/pdf/DR-27072020.pdf

3https://www.thestar.com.my/business/business-news/2020/07/20/banks-likely-to-be-spared-from-rating-downgrade

4https://www.nama.com.my/PRINT_NEWS/2020/10/26/20201026_N60_EDG_CR_18_FC_MALAYSIAS~PROBLEM~LOANS~EXPECTED~TO~RISE~BUT~NOT~AS~BAD~AS~REGIONAL~LENDERS.JPG

5https://www.nst.com.my/business/2021/01/655198/banks-asset-quality-still-concern-capital-strength-key-recovering-factor

6https://www.thestar.com.my/business/business-news/2021/01/25/all-eyes-on-banks-asset-quality

7https://www.bnm.gov.my/-/transfer-of-the-small-debt-resolution-scheme-to-agensi-kaunseling-dan-pengurusan-kredit-akpk-

8https://www.bernama.com/en/business/news.php?id=1939635

9https://www.thestar.com.my/business/business-news/2021/01/25/all-eyes-on-banks-asset-quality

10https://www.abm.org.my/media-room/press-releases/item/1122-targeted-moratorium-is-best-solution-for-country

11https://www.nst.com.my/business/2021/07/703969/malaysias-moratorium-flatten-peak-npls-delay-profit-recovery-fitch

12https://www.bnm.gov.my/documents/20124/4325086/2Q2021_GDP_Slides.pdf

13https://www.thestar.com.my/business/business-news/2021/08/14/interest-waiver-will-have-long-term-consequences

14https://www.mof.gov.my/ms/berita/siaran-media/mou-kerajaan-dan-pakatan-harapan-petanda-positif-untuk-pertumbuhan-dan-kestabilan-ekonomi-malaysia

15https://www.nama.com.my/PRINT_NEWS/2021/09/24/20210924_N60_EMB_HM_4_FC_INTEREST~RATE~WAIVER~IMPERATIVE~THAT~SHORT~TERM~RELIEF~MEASURES~DO~NOT~INCUR~LONG~TERM~DAMAGE~TO~ECONOMY~BNM.JPG

16https://www.nama.com.my/PRINT_NEWS/2021/09/27/20210927_N60_EDG_CR_16_FC_INTEREST~WAILVER~ON~LOANS.JPG

17https://www.nama.com.my/PRINT_NEWS/2021/10/16/20211016_N60_BOR_BZ_2_FC_URUS~WILL~NOT~LIKELY~IMPACT~BANKS~IN~THE~LONG~RUN.JPG

CONCLUSION

For borrowers who are able to start repayments, this would be in their interest as resuming repayments would reduce the borrowers’ overall cost of borrowings. Any loan forbearance will still assume an eventual full repayment of arrears.

Borrowers are reminded that the decision made from the beginning to apply and obtain bank loans marks a specified term of commitment and represents a significant financial obligation for an individual or a particular business. Therefore, rigorous financial planning and the availability of sound financial buffers against unexpected events are critical.

Alternatively, borrowers can approach the relevant “one-stop” centre to work out an appropriate assistance package i.e. AKPK for individuals and Small Debt Resolution Scheme (SDRS) for SMEs (effective 1 September 2020, BNM has transferred the SDRS function to AKPK to help SMEs, including micro SMEs1). As at 31 January 2021, AKPK has helped 32,349 people to fully settle their debts totalling RM1.5 billion via its debt management programme (DMP). According to AKPK’s Chief Executive Officer Encik Azaddin Ngah Tasir, since AKPK’s inception in 2006, the agency had extended its financial advisory services to over 1.2 million people. He also said that in 2020 alone, AKPK has helped 33,356 individuals to restructure their debts and place them on stronger footing, giving them clarity and direction in laying out their financial plans. As for SMEs, 161 applications were approved by the agency for debt restructuring services with loan amounts totalling RM 151.8 million from September 2020 to February 20212.

B50 borrowers whose gross monthly household income is RM5,880 or lower, are experiencing either a loss of employment or reduction of income of at least 50% and those whose loans are still performing (not in arrears exceeding 90 days) as at the date of their application are eligible for URUS which is monitored by AKPK. Under this programme, AKPK will provide the customer with a personalised financial plan that is developed holistically, taking into account the customer’s financial circumstances and ability to afford repayment of all financing obligations3.

AKPK stands ready to provide the necessary advice and guidance to both individual borrowers/customers and SMEs, including options for debt restructuring. In addition to contacting the banks, SMEs can also request for assistance through AKPK’s dedicated SME Help Desk at: akpk.org.my/smehelpdesk or akpk.org.my/my/mejabantuanpks. The virtual helpdesk provides free financial advice and facilitates applications for repayment assistance. AKPK currently has 10 branches located nationwide and has provided over 854,246 financial advisory sessions to households and SMEs4.

Recently, there have been reports that fraud and scam cases in the country are getting more rampant. In this regard, members of the public and businesses are advised to be cautious against fraud syndicates which deploy scam tactics with the intention to deceive unsuspecting victims that may result in monetary losses as well as risk compromising their sensitive banking details and confidential information. Members of the public and businesses seeking repayment assistance from banks must get in touch with the banks directly in order to avoid being deceived by these unscrupulous syndicates/ fraudsters.

1https://www.bnm.gov.my/-/transfer-of-the-small-debt-resolution-scheme-to-agensi-kaunseling-dan-pengurusan-kredit-akpk-

2https://www.bernama.com/en/business/news.php?id=1939635

3https://www.abm.org.my/media-room/press-releases/item/1600-applications-for-urus-now-open-for- eligible-b50-customers

4https://www.akpk.org.my/

Useful Links

- Measures to Address COVID-19 Impact

- IMSME

- FAQ on PENJANA Tourism Financing (EN)

- FAQ on PENJANA Tourism Financing (BM)

- Fund Features

PENJANA Tourism Financing - Announcement by MoTAC